Do enough each startup bookkeeping month to ensure no significant issues develop, then have a high-level check-in each quarter. Accounting and bookkeeping are intimately linked, but they’re not interchangeable. Understanding the difference between the two should help you clarify which financial responsibilities you can handle yourself and which you’ll need help with to complete. Apply for financing, track your business cashflow, and more with a single lendio account.

Best Online Bookkeeping Services for Startups 2024

You can apply for a business credit card using your personal credit score and income; business credit is not a requirement. If you’re considering a business credit card, you might want to look for one that offers a generous rewards program and/or charges no annual fee. Before starting a bookkeeping business, you’ll first need to know the basics of operating legally. It’s also helpful to understand how to market your services and manage the financial side of running a business. Starting a bookkeeping business is something you might be interested in if you naturally love numbers and want to break free of the traditional nine-to-five.

- If you’re ahead of the curve and using a paperless office, just save a record of the payment to their file.

- Don’t forget to integrate financial projections to assess your business’s potential growth and sustainability.

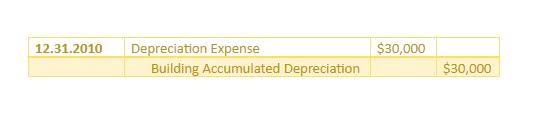

- In this accounting method, each transaction is assigned to a specific account using journal entries, and the changes in the accounts are recorded using debits and credits.

- Just look at your past numbers and predict when cash might get tight so you can prepare.

- As a busy entrepreneur, you likely spend long nights and early mornings working on the next big idea for your startup business.

Connect With Industry Leading AppsTo Level Up Your Accounting

Now, if you’re spending hours trying to sort out your finances and feeling like you’re barely keeping up, you could use some help. Payroll might not be the most exciting task on your list, but it’s one of the tasks you absolutely need to get it right. Plus, if employees aren’t paid on time, it leaves a bad taste, and honestly, that’s the last thing you want when you’re trying to build a solid team. Tax season can feel like a looming deadline, but it doesn’t have to be the stressful, anxiety-filled rush we all dread. You don’t want to end up rushing at the last minute, missing out on potential deductions, or worse, facing penalties. With a few simple steps, you can make tax season way more manageable.

Why Is Accounting Important for the Startup of a Business?

A strong understanding of your business’s financial health is essential to the success of https://www.bookstime.com/ your company. Startup accounting provides valuable insight into your startup’s cash flow and also allows you to make financial projections. Most importantly, it ensures that your startup is staying compliant. For QuickBooks Live’s bookkeeping services, you can expect to pay $200 per month minimum. You will also be required to pay a “clean-up fee” to begin your bookkeeping membership; however, this price is dependent on tax filing status, sign-up month, and business start date.

- If you’re a service-based startup that intends to stay small, FreshBooks is worth looking at.

- Kruze offers a variety of pricing plans to help startups afford accurate bookkeeping services.

- You want to avoid leaving any messes that will be overwhelming to you or your accountant in the future.

- Kruze’s finance and bookkeeping team combines experienced startup accountants with the best off the shelf, and custom built, accounting software.

- It’s the easiest to follow, and your bookkeeping software should be able to handle it.

- A strong understanding of your business’s financial health is essential to the success of your company.

- It’s crucial to stay on top of this paperwork so that come tax time, you’re not scrambling to find receipts or reconstructing your finances from memory.

Assuming that the startup has a bookkeeping software like QuickBooks Online set up, we recommend one of the founders DIY the books until the company has raised a reasonable amount of funding. The typical point where it starts to make sense to hire a startup bookkeeper is when a company has raised over $250,000 in funding and has 6+ months of runway. At that point, it makes more sense for the founders to be 100% focused on growing the business, and let an experienced startup bookkeeper handle the books.

Zoho Books Pricing

With hundreds of VC-backed startups in NYC and beyond, the Kruze team of CPAs and accounting professionals has the knowledge to help funded startups. As the venture capital ecosystem in New York has grown, so has Kruze’s NYC client base. Per PitchBook data, New York City startups continue to raise ever-bigger amounts of VC funding at ever higher and higher valuations. A qualified tax CPA like Kruze can likely help these companies save millions per year in payroll taxes through tax credit advice. As you can see, bookkeeping and accounting go hand in hand, but the two functions are usually divided up into two different roles—the bookkeeper and the accountant. We recommend QuickBooks Online (“QBO”) as the right bookkeeping software for early-stage companies and high growth small businesses.

- And don’t just keep these items until you turn your forms over to the tax collector.

- A bookkeeping service that provides dedicated bookkeepers or accountants as well as on-demand services is a plus.

- On the FreshBooks platform, you can create invoices, utilize accounting tools, make payments, track expenses, and manage time tracking and project costs.

- However, it may be difficult to find support when you eventually convert to an ERP, which will probably be required sooner with Zoho Books than with QuickBooks Online.

- Good bookkeeping provides entrepreneurs and small business owners with detailed, accurate, timely records that assist decision-making, taxes, and audits.

- It automatically creates a record for each financial transaction and helps you pay bills, schedule invoices, and create financial reports.

- This method is more complex, but it allows you to track a long-term picture of the business more accurately—something particularly useful when reporting to investors or making fast-paced scaling decisions.

When you start any new business, you can’t expect customers or clients to magically find you. Instead, you’ll have to invest some time (and perhaps, money) in marketing your business. Our account management team is staffed by CPAs and accountants who have, on average, 11 years of experience. They set up our books, finances, and other operations, and are constantly organized https://x.com/BooksTimeInc and on top of things. As a startup, you have to focus on your product and customers, and Kruze takes care of everything else (which is a massive sigh of relief).